WE PROVIDE REAL ESTATE BROKERAGE AND CONSULTING SERVICES

We are a Real Estate Services Company. As such, we provide professional brokerage and consulting services, at a personal level, to investors looking to buy, sell, develop, exchange, lease or finance commercial and residential real estate, including shopping centers, triple net leased stores and restaurants, office and industrial buildings, and single and multi-family residential properties. We also provide real estate lenders, borrowers and loan guarantors with consultation and assistance regarding debt and equity needs and restructuring.

Latest Posts

- Multifamily Transitions in 2024

2024 is shaping up to be a year of transition from impatience with the economy, to grudging acceptance that low interest rates are gone for good and consumer and worker shifts are here to stay. U.S. multifamily rents are declining at the exact same time as a 40-year high of new supply (554,000 units) comes… Read more: Multifamily Transitions in 2024

2024 is shaping up to be a year of transition from impatience with the economy, to grudging acceptance that low interest rates are gone for good and consumer and worker shifts are here to stay. U.S. multifamily rents are declining at the exact same time as a 40-year high of new supply (554,000 units) comes… Read more: Multifamily Transitions in 2024 - POVERTY, BY AMERICA

According to the Center on Poverty and Social Policy at Columbia University, 14.3% of Americans — nearly 50 million people — were living in poverty in December. “If America’s poor founded a country,” Matt Desmond writes in his book “Poverty, By America,” “that country would have a bigger population than Australia or Venezuela. Almost 1… Read more: POVERTY, BY AMERICA

According to the Center on Poverty and Social Policy at Columbia University, 14.3% of Americans — nearly 50 million people — were living in poverty in December. “If America’s poor founded a country,” Matt Desmond writes in his book “Poverty, By America,” “that country would have a bigger population than Australia or Venezuela. Almost 1… Read more: POVERTY, BY AMERICA - A Simple Explanation of Interest Rate Swaps

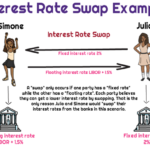

A swap is like a trade between two parties. In the case of a swap rate, it’s a trade between two types of interest rates. Let’s say there are two people: Alice and Bob. Alice has a loan with a fixed interest rate of 4%, and Bob has a loan with a variable interest rate… Read more: A Simple Explanation of Interest Rate Swaps

A swap is like a trade between two parties. In the case of a swap rate, it’s a trade between two types of interest rates. Let’s say there are two people: Alice and Bob. Alice has a loan with a fixed interest rate of 4%, and Bob has a loan with a variable interest rate… Read more: A Simple Explanation of Interest Rate Swaps

Experience and Expertise

We have the experience and expertise to provide complete representation in commercial and residential real estate transactions, including underwriting investment opportunities, and negotiating, reviewing and drafting purchase agreements, escrow instructions, leases, loan documents, and due diligence contracts and reports.Voted San Diego's Best Real Estate Company

Regal Properties is a California corporation licensed by the California Department of Real Estate, and based in San Diego, California — where it is consistently VOTED SAN DIEGO’S BEST REAL ESTATE COMPANY in the San Diego Union Tribune Readers Poll.Tools

Use our web tools for Residential and Commercial Real Estate listings, as well as foreclosure and multiple listings.Established Relationships

We have excellent established relationships with proven debt and equity financing sources for every property type, and experience handling complex financing and commercial mortgage-backed securities (“CMBS”) loans, IRC 1031 tax-deferred exchanges, and atypical transactions and capital restructures.Invests in People and Property

Regal Properties proudly Invests in People and Property by donating 10% of all fees and commissions to charitable causes — allowing the client to nominate any charity to receive half of that donation.Contact Us

We stand ready to serve your real estate needs. Contact us today.

Larry Murnane is the President and founder of Regal Properties. Licensed in California as an attorney since 1985 and as a real estate broker since 1992, Larry has extensive practical experience in commercial and residential real estate transactions and investments, which gives Regal Properties a strong competitive advantageLarry Murnane, President and Founder DRE Lic. #01130444