Multifamily Transitions in 2024

2024 is shaping up to be a year of transition from impatience with the economy, to grudging acceptance that low interest rates are gone for good and consumer and worker shifts are here to stay.

U.S. multifamily rents are declining at the exact same time as a 40-year high of new supply (554,000 units) comes online and tens of billions of dollars of floating-rate bridge loans are maturing.

About $1.2 trillion of debt on U.S. commercial ...

Read more

POVERTY, BY AMERICA

According to the Center on Poverty and Social Policy at Columbia University, 14.3% of Americans — nearly 50 million people — were living in poverty in December. “If America’s poor founded a country,” Matt Desmond writes in his book “Poverty, By America,” “that country would have a bigger population than Australia or Venezuela. Almost 1 in 9 Americans – including 1 in 8 children – live in poverty. There are more than 38 million ...

Read more

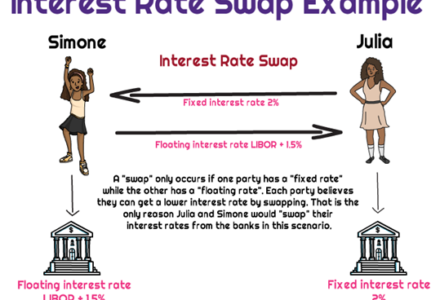

A Simple Explanation of Interest Rate Swaps

A swap is like a trade between two parties. In the case of a swap rate, it's a trade between two types of interest rates.

Let's say there are two people: Alice and Bob. Alice has a loan with a fixed interest rate of 4%, and Bob has a loan with a variable interest rate that fluctuates based on market conditions. They agree to swap their interest rates for a certain amount of time, let's ...

Read more

California Plans to Build 2,500,000 Inclusionary Homes by 2030

The California Department of Housing and Community Development (HCD) now seems committed to addressing the state’s current housing crisis. Decades of underproduction, underscored by exclusionary policies, have left housing supply far below demand, resulting in soaring prices. As a result, millions of Californians, consisting of disproportionately lower income and people of color, must make hard decisions about paying for housing at the expense of food, healthcare, childcare, and transportation—such that one in three households ...

Read more

APARTMENT INVESTMENTS HEDGE INFLATION CONCERNS

The Federal Reserve sees core inflation ending the year at just over 4% after raising the Federal funds rate to 1.9%. This inflation creates strategic issues from an investment perspective.

For bondholders, inflation erodes principal value. Furthermore, because the coupon on most fixed income securities remains the same until maturity, the purchasing power of the interest payments declines as inflation rises.

For equity investors, the problem relates to stock valuation methods. Market participants frequently discount future cash ...

Read more

PANDEMIC PAYDAY: ULTRAWEALTHY ADDED $1.2B PER DAY WHILE INEQUALITY KILLED MILLIONS

A new report explains how inequality contributed to the death of 21,000 people each day of the pandemic while the wealthiest collectively got $1.2 billion richer every 24 hours.

Oxfam International’s latest report on global inequality finds that while the 10 richest individuals in the world more than doubled their collective wealth since COVID-19 hit in 2020, the related result of this billionaire surge has been a deadlier and more prolonged pandemic for the rest ...

Read more

2022 Capital Gains Tax Rate Thresholds

2022 Capital Gains Tax Rate Thresholds

Capital GainsTax RateTaxable Income(Single)Taxable Income(Married Filing Separate)Taxable Income(Head of Household)Taxable Income(Married Filing Jointly)0%Up to $41,675Up to $41,675Up to $55,800Up to $83,35015%$41,675 to $459,750$41,675 to $258,600$55,800 to $488,500$83,350 to $517,20020%Over $459,750Over $258,600Over $488,500Over $517,200

Tax on Net Investment Income

There's an additional 3.8% surtax on net investment income (NII) that you might have to pay on top of the capital gains tax. (NII includes, among other things, taxable interest, dividends, gains, passive ...

Read more

San Diego Ranked #1 MOST FUN Place to Live in the U.S.

According to U.S. News & World Report analyzing 150 metro areas in the United States to find the best places to live -- based on quality of life, job market in each metro area, the value of living there and people's desire to live there -- San Diego is the “most fun” place to live in the U.S. The Southern California beach city is ranked #1 for its sunny weather, amazing beaches, beautiful and ...

Read more

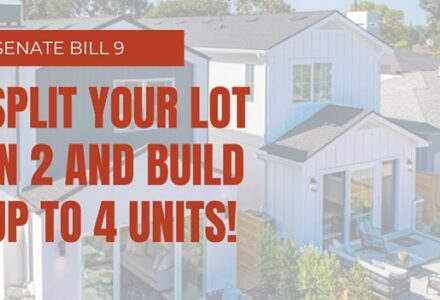

Governor Newsom Ends Single Family Zoning in California

Governor Newsom signed Senate Bill 9 into law in September 2021, which effectively eliminates single family zoning throughout the state of California.

SB 9 requires jurisdictions to ministerially approve a housing development of two dwelling units on a non-historic single-family zoned parcel, and to also ministerially approve a lot split for existing non-historic single-family zoned parcels of 2,400 square feet or greater, subject only to limited exceptions. This means that an existing parcel with one ...

Read more

WHY INVEST IN SAN DIEGO AND CALIFORNIA in 2021-2022?

Though some people are leaving California, San Diego and California continue to attract more affluent and highly educated people from across the nation and internationally, creating a mega-market for the housing.60% of adults moving to California have a bachelor’s degree or higher.The unemployment rate in California among those with college degrees is 2.9%, with San Diego County total unemployment below 7%.San Diego County has gained 50,000 new jobs since January 2021.In 2020, more than ...

Read more

© 2018 Regal Properties. All Rights Reserved.