Multifamily Transitions in 2024

2024 is shaping up to be a year of transition from impatience with the economy, to grudging acceptance that low interest rates are gone for good and consumer and worker shifts are here to stay.

U.S. multifamily rents are declining at the exact same time as a 40-year high of new supply (554,000 units) comes online and tens of billions of dollars of floating-rate bridge loans are maturing.

About $1.2 trillion of debt on U.S. commercial ...

Read more

POVERTY, BY AMERICA

According to the Center on Poverty and Social Policy at Columbia University, 14.3% of Americans — nearly 50 million people — were living in poverty in December. “If America’s poor founded a country,” Matt Desmond writes in his book “Poverty, By America,” “that country would have a bigger population than Australia or Venezuela. Almost 1 in 9 Americans – including 1 in 8 children – live in poverty. There are more than 38 million ...

Read more

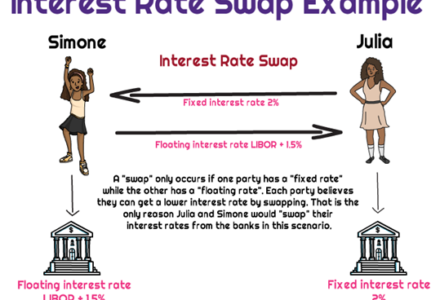

A Simple Explanation of Interest Rate Swaps

A swap is like a trade between two parties. In the case of a swap rate, it's a trade between two types of interest rates.

Let's say there are two people: Alice and Bob. Alice has a loan with a fixed interest rate of 4%, and Bob has a loan with a variable interest rate that fluctuates based on market conditions. They agree to swap their interest rates for a certain amount of time, let's ...

Read more

California Plans to Build 2,500,000 Inclusionary Homes by 2030

The California Department of Housing and Community Development (HCD) now seems committed to addressing the state’s current housing crisis. Decades of underproduction, underscored by exclusionary policies, have left housing supply far below demand, resulting in soaring prices. As a result, millions of Californians, consisting of disproportionately lower income and people of color, must make hard decisions about paying for housing at the expense of food, healthcare, childcare, and transportation—such that one in three households ...

Read more

Commercial Real Estate Investor Strategies After Prop 19 in California

Under the newly passed Proposition 19 in California, property taxes on commercial real estate will now be reassessed upon any transfer from parent to child. This new consequence of death will likely lead to the sale of many inherited commercial real estate investment properties because the reassessment renders the property a less desirable investment. However, can parents still transfer such property to their children without reassessment? Possibly.

Assume, for example, the parents own an apartment ...

Read more

How Proposition 19 Affects California Homeowner Property Taxes

Recently passed Proposition 19 in California affects homeowners in 2 key ways: (1) making it easier for owners over 55 or victims of natural disasters to relocate, and (2) restricting the exempt intra-family transfers (aka parent to child or grandparent to grandchild).

Primary Residence Transfers

Prop. 19 allows persons over 55 and victims of a wildfire or natural disaster to make three transfers per lifetime, in any county in California, and that they may do so ...

Read more

1031 Exchange Trap – You Could Have Less Than 180 Days

IRC Section 1031’s regulations state, “The exchange period begins on the date the taxpayer transfers the relinquished property and ends at midnight on the earlier of the 180th day thereafter or the due date (including extensions) for the taxpayer’s return of tax imposed by chapter 1 of subtitle A of the Code for the taxable year in which the transfer of the relinquished property occurs.”

Thus, the regulations generally allow for 180 calendar days for ...

Read more

2020 Best

Thank you, clients and peers, for this recognition again in 2020. We look forward to helping you with the purchase, sale, leasing, financing and development of any residential or commercial real estate product type anywhere in the USA in 2021. And to show our gratitude, Regal Properties will continue "Investing in People and Property" by donating 10% of all fees and commissions to charities -- allowing our clients to designate the charity to receive ...

Read more

2019 Housing Outlook

Expect housing in 2019 to be

flat. The recent decline in mortgage rates from 5% to 4% for the 30-year-fixed

provides some support for housing.

However, the tax-law change, which took away many of the tax benefits of

homeownership, weighs on demand. The impact of the new tax law is still

filtering through the housing market, particularly in more expensive markets

like California, and Florida, where those tax benefits are more important.

Affordability remains an issue. The

runup in house prices over ...

Read more

© 2018 Regal Properties. All Rights Reserved.