POVERTY, BY AMERICA

According to the Center on Poverty and Social Policy at Columbia University, 14.3% of Americans — nearly 50 million people — were living in poverty in December. “If America’s poor founded a country,” Matt Desmond writes in his book “Poverty, By America,” “that country would have a bigger population than Australia or Venezuela. Almost 1 in 9 Americans – including 1 in 8 children – live in poverty. There are more than 38 million ...

Read more

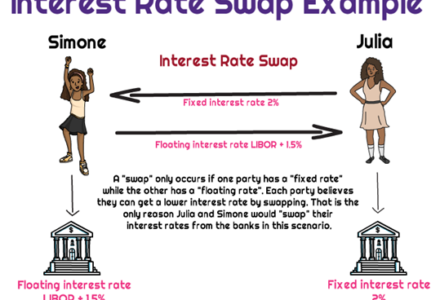

A Simple Explanation of Interest Rate Swaps

A swap is like a trade between two parties. In the case of a swap rate, it's a trade between two types of interest rates.

Let's say there are two people: Alice and Bob. Alice has a loan with a fixed interest rate of 4%, and Bob has a loan with a variable interest rate that fluctuates based on market conditions. They agree to swap their interest rates for a certain amount of time, let's ...

Read more

California Plans to Build 2,500,000 Inclusionary Homes by 2030

The California Department of Housing and Community Development (HCD) now seems committed to addressing the state’s current housing crisis. Decades of underproduction, underscored by exclusionary policies, have left housing supply far below demand, resulting in soaring prices. As a result, millions of Californians, consisting of disproportionately lower income and people of color, must make hard decisions about paying for housing at the expense of food, healthcare, childcare, and transportation—such that one in three households ...

Read more

5 STEPS TO BE, HAVE, DO AND ACCOMPLISH ANYTHING

Your aim is to do something GREAT and wonderful with your life, and to accomplish extraordinary things. However, you cannot simply go out and have a great life; you must go out and make a great life!

The word “GREAT” has 5 letters, which stand for the 5 keys to success in your life, and in anything you decide to be, have, do and accomplish:

1. GOALS: You must know exactly what you desire to be, ...

Read more

Recession Amendments to California’s Anti-Deficiency Laws

During the recent recession, California’s legislature has amended the real estate anti-deficiency laws in the Code of Civil Procedure in three important ways:

No Deficiency Judgment for Approved Short Sales: SB 931 added subsection "e" to CCP Section 580, which prohibited any first lender who approved a short sale from obtaining a deficiency judgment against the seller. Subsequently, the enactment of SB 458 provided that any home mortgage lenders who approved short sale transactions, which ...

Read more

Commercial Real Estate Loan Workout Strategies

Increasing vacancies, decreasing rents, negative cash flows, rising cap rates, imprecise valuations, severely constrained financing, and personal guaranties will continue to put severe pressure on over-leveraged commercial real estate owners during the next few years. As the wave of commercial property loan defaults begins to crest, borrowers should be armed and prepared with practical strategies and solutions for dealing with their under-performing properties and maturing loans.

Foresight Analytics recently estimated about two-thirds of the $800 ...

Read more

California Real Estate Foreclosure Procedures, Timelines and Strategies for Lenders and Borrowers

This article will provide a general summary of real property foreclosure procedures, timelines and strategies for borrowers and lenders in California.

As a precursor, it helps to understand that the creditor typically has a promissory note evidencing the loan or mortgage, which is secured by a recorded deed of trust. The deed of trust identifies the trustor, trustee and beneficiary, as well as the property securing the note. The truster is the debtor, and the ...

Read more

The Landlord’s Response to a Retail Tenant’s Request for Rent Reduction

Retail landlord’s everywhere have almost certainly experienced tenant requests for rent reductions during these challenging economic times. When responding to such requests, the landlord should consider doing the following:

1. Require a written confidentiality agreement before discussing any rent or other lease modifications with the tenant, to reduce the risk of opening a Pandora’s Box with other tenants.

2. Ask the tenant to provide a current financial statement, a report of annual sales for the last ...

Read more

Minimizing the Risks of Purchasing Commercial Real Estate

Almost everyone is familiar with the three cardinal rules of real estate investment: “Location, Location and Location.” Although property well situated certainly has fewer risks, an investor must carefully consider other ways to minimize the risks involved in the purchase of commercial real estate.

Focusing the Search

Commercial real estate includes apartment, office, industrial, retail and other income properties. Each of these property types has different advantages and disadvantages, risks and opportunities. Most commercial real estate ...

Read more

Anonymity and Other Benefits of Title Holding Trusts

A Title Holding Trust (“THT”), sometimes referred to as a land trust, holding trust or blind trust, can be a simple and inexpensive method for taking and holding title to California real estate or personal property, confidentially and privately .

A THT can be established by an individual, partnership, trust, limited liability company or corporation. The person or entity that sets-up the THT, the Trustor, enters into a standardized THT Agreement with the Trustee he or ...

Read more

© 2018 Regal Properties. All Rights Reserved.