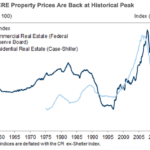

As commercial real estate (“CRE”) prices hit an historical peak for retail, industrial, office and multi-family investment properties, the earnings yields on other assets like stocks bonds have declined significantly, making steep CRE prices still seem more reasonable from an asset pricing perspective. However, CRE investors would be wise not to over-leverage with cheap debt, such that a future bump up in interest rates, slowing of growth, decline in rents and/or increase vacancies jeopardizes the investment. Remember what happened between 2007-2010, and be smart and realistically conservative when underwriting any CRE investment.

CRE Investors Should Exercise Caution As Prices Peak

© 2018 Regal Properties. All Rights Reserved.