A swap is like a trade between two parties. In the case of a swap rate, it’s a trade between two types of interest rates.

Let’s say there are two people: Alice and Bob. Alice has a loan with a fixed interest rate of 4%, and Bob has a loan with a variable interest rate that fluctuates based on market conditions. They agree to swap their interest rates for a certain amount of time, let’s say one year.

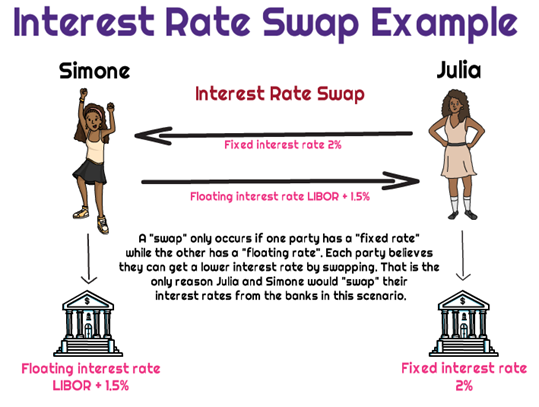

Alice agrees to pay Bob the fixed interest rate of 4% on his loan for one year, and in return, Bob agrees to pay Alice the variable interest rate on her loan for one year. The variable interest rate might be higher or lower than the fixed rate, depending on how the market is doing.

So why would they do this? Well, Alice might want to take advantage of any potential decreases in interest rates over the next year, while Bob might want to lock in a fixed rate in case interest rates go up. By swapping, they both get what they want.

Swap rates are the rates at which these swaps take place between parties. They are usually quoted as the difference between the fixed interest rate and the variable interest rate, and are used by banks and financial institutions to manage their own interest rate risk.